大浩浩的笔记课堂——FRM考试学习笔记077

- 2026-01-04 19:35:25

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

1.Incorporating liquidity:

⑴introduction:

①exogenous:

the transaction cost for trades of average size(transaction costs)

②endogenous:

the cost of unwinding portfolios large enough(price impact)

⑵types:

①exogenous liquidity

②endogenous liquidity:

A.motivation:

a/ adverse market conditions

b/ margin requirements

c/ the trading activities associated with hedging

B.importance:

a/ underlying asset is not very liquid

b/ size of the position

c/ small investors follow the same hedging strategy

d/ asymmetric information:

magnifies the sensitivity of prices to cluster of similar trade

⑶adjusting:

adjusting the VAR time horizon to account for liquidity risk:

Liquidity horizons vary over the business cycle,increasing during times of market stress.

⑷conclusions:

①exogenous liquidity:

"liquidity-adjusted VAR" approach:

partially incorporate in the valuation of trading portfolios

②endogenous liquidity:

depends on trade size:

its risk is particularly relevant for exotically complex trading positions

2.Risk measures:

⑴measurement indexes:

①value at risk(VAR):

A.advantages:

conceptual simplicity,computational facility,really applicability.

B.disadvantages(problems):

a/ 不适用于非流动性资产,即基于历史价格的非流动性效用。

b/ 超过VAR的损失无法计量:

△VAR不能视为最坏损失度量;

△VAR不能描述左尾损失程度。

c/ 简单的映射问题,即VAR通常简化系统而忽视建模的复杂性。

d/ 窗口变动性问题,即对于近期历史数据过度依赖。

e/ 周期性问题,即杠杆和使用风险敏感性度量的损失组合管理的结合问题:

△Accuracy of simple VAR measures diminish as time horizon lengthens.

△The effect of time-varying volatility on accurate VAR measures is decreasing.

f/ 拥挤交易,即羊群效应问题。

g/ VAR is criticized for not being a coherent risk measure:

not subadditivity

C.characteristics:

A risk measure R is called coherent if it satisfied:

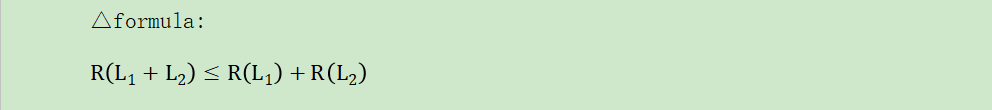

a/ subadditivity 次可加性:

△概念:

其是指投资组合的风险必须小于等于单个风险的和。

△formula:

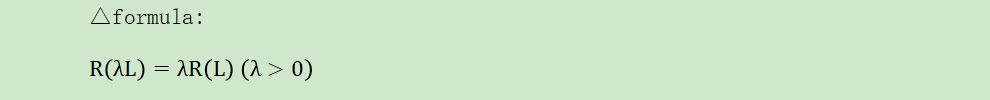

b/ positive homogeneity 齐次性:

△概念:

其是指以因子增加投资组合的价值会同样以因子增加其的风险量。

△formula:

c/ monotonicity 单调性:

△概念:

其是指如果一个投资组合的价值系统性地低于另一个,那么在任何状态下,它一定具有更大的风险。

△formula:

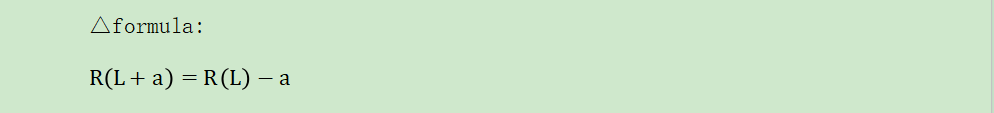

d/ transition property 平移不变性:

△概念:

其是指在投资组合中加入现金,将降低它同样的风险,同时也降低了投资组合的价值。

△formula:

②expected shortfall(ES):

A.improvement:

ES corrects three shortcomings of VAR:

a/ ES does account for the severity of losses beyond the confidence threshold.

b/ ES is always subadditive and coherent.

c/ ES mitigates the impact that the particular choice of a single confidences level.

B.formula:

tail conditional expectation(TCE)=conditional VAR(CVAR)

C.backtesting:

It is more complicated and/or less powerful than backtesting VAR.

③special risk measures(SRM):

A.case:

The ES is a special case of special risk measure.

B.advantages:

a/ SRMs consider a manager´s aversion to risk.

b/ SRMs have the ability to modify the risk measure to reflect an investors specific risk aversion.

c/SRMs have better smoothness properties when weighting observations.

d/ SRMs are not bound to a single confidence level.

C.usage:

SRMs other than ES are sill seldom used in practice.

⑵measurement approaches:

①compartmentalized approach(non-integrated approach):

A.definition:

The sum of risks are measured separately.

B.application:

The Basel framework is based on a "building block" approach such that a bank´s regulatory capital requirement is the sum of the capital requirements for each of the defined risk categories,which are calculated separately within the formulas and rules that make up Pillar 1.

C.draw back:

The current regulatory systems encourage move risk-taking when times are good.

②unified approach(integrated approach):

A.definition:

It considers the interaction between these risk explicitly.

B.application:

It would,by contrast,calculate capital for all the risks borne by a bank simultaneously in one single step and accounting for possible correlations and interactions.

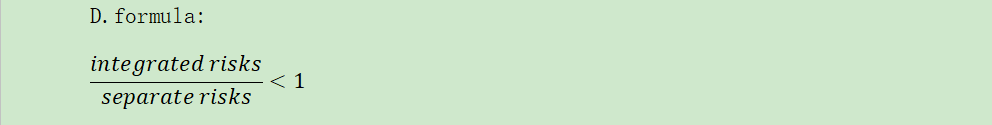

③top-down approach:

A.assumption:

A bank´s portfolio can be clearly subdivided according to market,credit and operational risk measures.

B.definition:

Risks are separable and can be aggregated in some way.

C.usage:

It suggests the risk diversification is present.

D.formula:

④bottom-up approach:

A.definition:

It is better account for the interaction among risk factors.

B.usage:

The risk diversification should be questioned due to the evidence of risk compounding.

C.formula:

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value