大浩浩的笔记课堂——FRM考试学习笔记106

- 2026-02-07 02:57:57

Topic 35 Credit Scoring and Retail Credit Risk Management

1.Background:

⑴Basel´sdefinition of retail exposures:

Retail exposures as homogenous portfolios that consist of:

①a large number of small,low-value loans

②with either a consumer or business focus

③where the incremental risk of any single exposure is small

⑵retail banking:

①the industry:

The retail banking industry revolves around receiving deposits from and lending money to consumers and small businesses.

②the business of accepting consumer deposits

③the main consumer lending business:

A.home mortgages:

a/ fixed-rate mortgage

b/ adjustable-rate mortgage

B.home equity loans(secured by residential properties)

C.installment loans:

including revolving loans,creditcards,automobile and similar loans,others

D.creditcard revolving loans(unsecured loans)

E.small business loans(SBL)(secured by assets or the personal guarantees)

2.The nature of retail credit risk:

⑴the defining feature:

They arrive in bite-sized pieces.

⑵To behave like well-diversified,but it can be prove to be a fickle trend.

⑶The dark side of retail risk management has 4 prime causes:

·特别注意!

·The dark side means that losses to rise,values declines and default rate increase.

①Not all innovative retail credit products have enough historical loss data.

②Credit products might begin to behave in an unexpected fashion under the influence of a sharp change in the economic environment.

·特别注意!

·e.g.process flaws resulting in high risk applicants receiving debt

③The tendency of consumers to default is a product of a complex social and legal system that continually changes.

④Any operational issue that affects the credit assessment of customers can have a systematic effect on the whole consumer portfolio.

·特别注意!

·CFPA—evaluate quantified mortgages and ability to repay

·Banks must segment their portfolios and set aside risk capital as well as PD,EAD,LGD.

⑷The bank can take preemptive action to reduce credit risk:

①Alter the values governing the amount of money it leads to existing customers to reduce its exposures.

②Alter its marketing strategies and customer acceptance rules to attract less risky customers.

③Price in the risk by raising interest rates for certain kinds of customers to take into account the higher likely hood of default.

·特别注意!

·retail credit risk vs. corporate(commercial) credit risk:

retail credit risk | corporate(commercial) credit risk |

Retail credit exposures are relatively small or one default has minimal impact. | A commercial credit portfolio often consists of large exposures or single default can have a significant impact. |

Due to the diversification of a retail credit portfolio,estimating the default percentage allows a bank to treat this loss as a cost of "dong business". | A commercial credit portfolio is subjected to the risk that its losses may exceed the expected threshold. |

Lenders can take preemptive actions to reduce retail credit risk. | Commercial portfolios often send warning signals after it is too late. |

⑸the other risks of retail banking:

①interest rate risk(both asset and liability side):

The bank provides specific rates,and rates change in the market place.

②asset valuation risk(special form of market risk):

e.g.refinancing a mortgage when rates decrease

③operational risks:

e.g.day-to-day risks associated with running the business.

④business risks:

A.business volumes risk;

B.strategic risk;

C.decisions about mergers and acquisitions

⑤reputation risks(primarily a concern for the lender):

It is the bank´s reputation with customers and regulators.

3.What kind of credit scoring models are there?

⑴There are really 3 types of models:

①credit bureau scores(an applicant´s FICO scores):

A.low cost,quickly installed

B.分数为300至800

②pooled models:

A.They are built by outside parties,is more costly than implementing a credit bureau score model.

B.However,it offers the advantage of flexibility to tailor it to a specific industry.

③custom models:

A.developed in-house:

They are created by the lender itself using data specifically pulled from the lender´s own credit application pool.

B.tailed to screen for specific;

C.expensive than 1.

⑵Each credit file contains 5 major types of information:

①identifying information:

personal information,not used in scoring models

②public record(legal items);

③collection information;

④trade line/account information

⑤inquiries

·特别注意!

·The more likely it is that a customer will default,the higher the interest rate the bank will change.

·The higher the score,the lower the risk that the borrower won´t be able to pay the debt obligation.

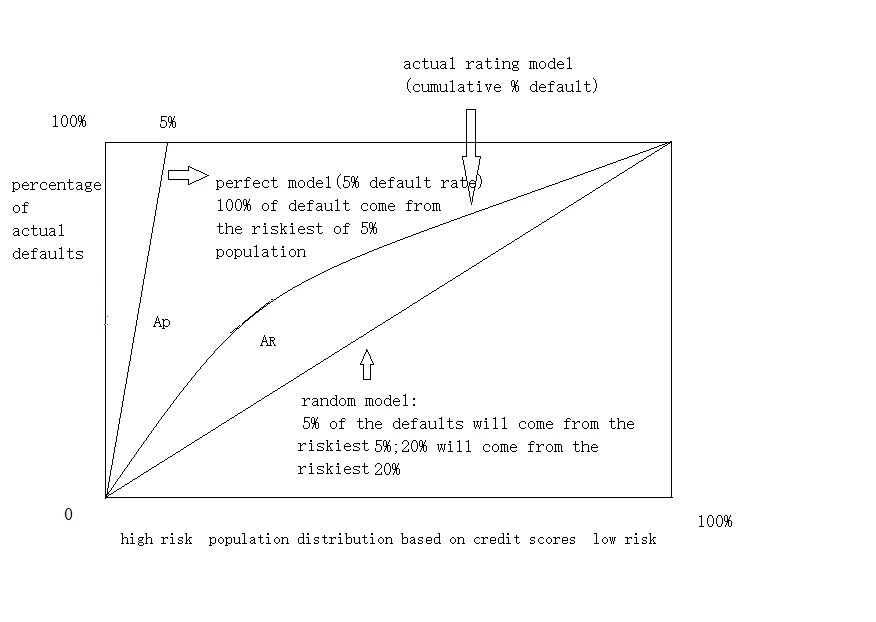

⑶the measures of performance models——CAP:

①the cumulative accuracy profile(CAP,GINI curve):

②the accuracy ratio(AR):

A.definition:

It is defined as AR/(AP+AR).

B.characteristic:

With a ratio close to 1,it is implying a more accurate model.

4.From default risk to customer value:

⑴scoring applications at one point in time→behavior scoring

⑵A couple of significant trends have emerged to improve this classic approach to credit scoring and its application:

①There has been a bigger push to understand how changes in macro economic factors might affect the behavior of given score bonds.

②Firms have begun to look more closely at how they can test responses to variations in product offerings and then monitor the early performance of those taking up retail offers:

There trends make retail banking more forward-looking,granular,and responsible to social and economic change.

5.The Basel regulatory approach:

⑴The Basel Ⅲ regulatory framework allows banks to use:

①standardized approach

②advanced approach:

The bank itself estimates parameters to calculate the required amount of regulatory capital.

⑵There are 3 retail subsectors:

①residential mortgages;

②revolving credit;

③other retail exposure(e.g.installment loans)

6.Securitization and market reforms:

⑴Selling the cash flows from these loans to investors through some kind of securitization means that the bank gains a principal payment up front,rather than having the money trickle in over the life of the retail product.

⑵The bank substantially shifts the risk of the portfolio to the investors and through this process reduces the economic risk associated with the portfolio.The bank gives up part of its income from the borrowers and is left with a profit margin that should compensate it for the initiation of the loans and for surviving them.

⑶Sometimes,this means that only a much smaller amount of the economic risk of the portfolio is transferred to investor.

⑷In the run-up to 2007—2009 financial crisis:

There is 3 key trends undermined the health of the mortgage securities market:

①Subprime and similarly risky lending began to be originated specifically for securitization.(lightly capitalized/regulated,no longer-term interest)

②Subprime credit was wrapped up into complex securities.(given high ratings)

③Banks failed to distribute the securitized risk and instead hold large amounts of the securitized risk themselves.

⑸the securitization reforms:

①improving disclosure and transparency about the assets underlying the securitization

②make originators more accountable

③making rating methodologies and raging agencies more accountable

④set better capital requirements

7.Mortgage credit assessment:

⑴the key variables including:

①FICO score;

②loan-to-value(LTV) ratio;

③debt-to-income(DTI) ratio;

④payment type;

⑤documentation types:

A.full doc

B.stated income——income is not verified

C.no ratio——no debt-to-income(DTI) ratio

D.no income/no asset——not lender verified

E.no doc

⑵cutoff scores:

①definition:

It represents thresholds where lenders determine whether they will or will not lend money to a particular borrower.

②range:

It would not be too high or too low.

③formula:

The probability of default(PD) and loss given default(LGD) metrics are critical to assessing the risk associated with various lender portfolios:

PD=loss rate/LGD

8.Trade off between creditworthiness and profitability:

⑴For new and existing credit applicants,lenders may use a variety of score cards to evaluate both creditworthiness and potential profitability.

⑵The customer relationship cycle involves marketing products,screening applicants,managing customer accounts and eventual cross-selling to an existing customer base.

9.Risk-based pricing:

It involves changing different prices for the same product such that higher prices can be changed to higher risk customers.

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift

Topic 15 The Art of Term Structure Models:Volatility and Distribution

Topic 16 Overnight Index Swap(OIS) Discounting

B.Credit Risk

B.信用风险

Topic 20 Default Risk:Quantitative Methodologies

Topic 21 Credit Risks and Credit Derivatives

Topic 22 Credit and Counterparty Risk

Topic 23 Spread Risk and Default Intensity Models

Topic 25 Structured Credit Risk

Topic 26 Defining Counterparty Credit Risk

Topic 27 The Evolution of Stress Testing Counterparty Exposures

Topic 28 Netting,Compression,Resets,and Termination Features

Topic 32 Default Probability,Credit Spreads and Credit Derivatives

Topic 33 Credit Value Adjustment(CVA)