大浩浩的笔记课堂——FRM考试学习笔记086

- 2026-01-07 10:48:31

Topic 15 The Art of Term Structure Models:Volatility and Distribution

1.Model 3:

time-dependent volatility:

⑴improvement:

It assigns a specific parameterization of time-dependent volatility.

⑵formula:

dr=λ(t)dt+σ(t)dw

⑶characteristics:

①They are very flexible and can incorporate increasing,decreasing and constant short-term rate volatilities between periods.

②This flexibility is useful for valuing interest rate caps and floors.

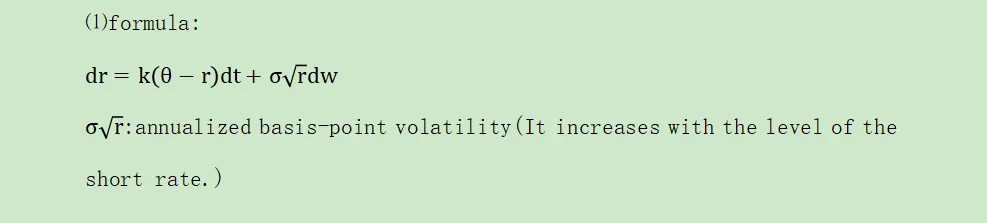

2.The Cox-Ingersoll-Ross(CIR) model:

volatility as a function of the short rate:

⑴formula:

⑵advantages:

①CIR model withe respect to not allowing negative rates.

②Basis-point volatility increases during periods of high inflation.

⑶disadvantage:

Option prices from the CIR distribution may differ significantly from lognormal or normal distribution.

3.Model 4:

lognormal model:

⑴assumption:

①Yield volatility,σ,is constant;

②But basis-point volatility,σr,increases with the level of the short-term rate.

③The natural log of the short-term rate follows a normal distribution.

⑵important models:

There are 2 lognormal models of importance:

①lognormal with deterministic drift:

Ho-Lee model based on the natural logarithm

②lognormal with mean reversion:

Black-Karasinski model

4.The Ho-Lee model:

a lognormal model with drift:

The Ho-Lee model based on the natural logarithm:

d[In(r)]=a(t)dt+σdw

The drifts terms are multiplicative.

5.The Black-Karasinski model:

a lognormal model with mean reversion:

⑴formula:

d[In(r)]=k(t)[Inθ(t)-In(r)]dt+σ(t)dw

①It is time-varying and mean reverting.

②It refers to Inθ(t)at a speed of k(t)with a volatility of σ(t).

⑵characteristics:

①Mean reversion controls the term structure of volatility.

②Time dependent volatility controls the future volatility of the short-term rate.

③The time intervals between interest rate changes are recalibrated to force the node to recombine.

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift