大浩浩的笔记课堂——FRM考试学习笔记132

- 2026-02-22 10:54:41

D.Investment Risk

D.投资风险

Topic 61 Factor Theory

1.Factors that impact asset prices(factor risks):

⑴Exposure to different factor risks earns risk premiums.

⑵Underlying factors may include the market,interest rates,investing styles,inflation and economic growth.

⑶Factor risks represent exposures to bad times,and this exposure must be compensated for with risk premiums.

⑷There are 3 important principles of factor risk:

①It is not exposure to the specific asset that matters,rather the exposure to the underlying risk factors.

②Assets represent bundles of factors,and assets´ risk premiums reflect these risk factors.

③Investors each have different optimal exposures to risk factors,including volatility.

2.Capital asset pricing model(CAPM):

⑴assumptions:

①Investors only have financial wealth.

②Investors have mean-variance utility.

③Investors have a single period investment horizon.

④Investors have homogenous(identical) expectations.

⑤All investors are price takers except the infinitely risk-averse investors who would only hold risk-free asset.

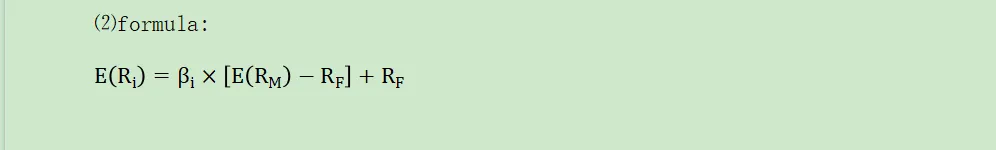

⑵formula:

⑶characteristics:

①It is a single-factor model that describes how an asset behaves in relation to other assets and to the market.

②The CAPM incorporates an asset´s covariance with the market portfolio,measured by the asset´s beta.

③In the CAPM world,the only relevant factor is the market portfolio,and risk premiums are determined solely by beta.

⑷lessons:

①Holding the factors,not the individual asset.

②Investors have their own optimal factor risk exposures.

③The average investor is fully invested in the market and holding the market portfolio.

④Exposure to factor risk must be rewarded.

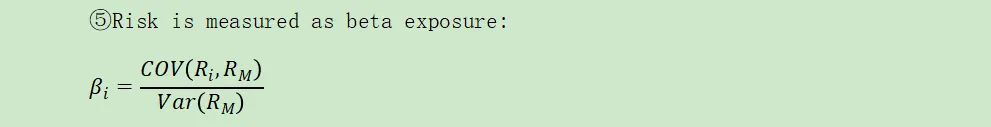

⑤Risk is measured as beta exposure:

⑥Valuable assets have low risk premiums.

⑸shortcomings:

①Investors only have financial wealth.

②Investors have mean-variance utility.

③Investors have a single period investment horizon.

④Investors have homogenous(identical) expectations.

⑤Markets are frictionless.

⑥All investors are price takers.

3.Multifactor model:

⑴lessons:

There are 6 lessons from the multifactor models:

①Diversification is beneficial.

②Investors have optimal exposures,to factor risks in multifactor model.

③The average investor holds the market portfolio.

④Exposure to factor risk must be rewarded through risk premiums.

⑤Risk is measured by factor betas.

⑥Valuable assets have low risk premiums.

⑵example:

arbitrage pricing theory(APT):

①definition:

It uses systematic factors that can not be removed through arbitrage,for which investors must be compensated for through risk premiums.

②hypothesis:

efficient market hypothesis(EMH)

③characteristics:

A.rational explanation of behavioral biases:

Losses during bad times are compensated for high returns.

B.the behavioral explanation:

It is agents´ under- or overreactions to news that generates high returns.

C.the market barriers:

Market barriers may make it difficult to take advantage of mispricings.

4.Pricing Kernels

stochastic discount factor(SFD):

⑴definition:

It represents an index of bad times.

⑵formulas:

①m=a+b×Rm

②m=a+b1f1+b2f2+……+bkfk

③Pi=E(m×pay offi)

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift

Topic 15 The Art of Term Structure Models:Volatility and Distribution

Topic 16 Overnight Index Swap(OIS) Discounting

B.Credit Risk

B.信用风险

Topic 20 Default Risk:Quantitative Methodologies

Topic 21 Credit Risks and Credit Derivatives

Topic 22 Credit and Counterparty Risk

Topic 23 Spread Risk and Default Intensity Models

Topic 25 Structured Credit Risk

Topic 26 Defining Counterparty Credit Risk

Topic 27 The Evolution of Stress Testing Counterparty Exposures

Topic 28 Netting,Compression,Resets,and Termination Features

Topic 32 Default Probability,Credit Spreads and Credit Derivatives

Topic 33 Credit Value Adjustment(CVA)

Topic 35 Credit Scoring and Retail Credit Risk Management

Topic 38 Understanding the Securitization of Subprime Mortgage Credit

C.Operational Risk

C.操作风险

Topic 39 Principles for the Sound Management of Operational Risk

Topic 40 Enterprise Risk Management:Theory and Practice

Topic 41 Observations on Developments in Risk Appetite Frameworks and IT Infrastructure

Topic 42 Operational Risk Data and Governance

Topic 45 Validating Rating Models

Topic 47 Risk Capital Attribution and Risk-Adjusted Performance Measurement

Topic 48 Range of Practices and Issues in Economic Capital Framework

Topic 49 Capital Planning at Large Bank Holding Companies

Topic 50 Repurchase Agreements and Financing

Topic 51 Assessing the Quality of Risk Measures

Topic 52 Estimating Liquidity Risks

Topic 53 Liquidity and Leverage

Topic 54 The Failure Mechanics of Dealer Banks

Topic 56 Introduction of Basel Accord

Topic 58 Basel Ⅱ.5 and Fundamental Review of the Trading Book(FRTB)