大浩浩的笔记课堂——FRM考试学习笔记115

- 2026-02-04 08:44:10

Topic 44 Capital Modeling

1.Operational risk capital:

Basel Ⅱ provides 3 main approaches to calculate operational risk capital:

⑴basic indicator approach(BIA)

⑵standardized approach or alternative standardized approach

⑶advanced measurement approach

·特别注意!

·International active banks usually select the standardized approach and the advanced measurement approach.

·Large financial institutions select the advanced measurement approach.

2.Basic indicator approach(BIA):

⑴definition:

It measures the capital charge on a firm-wide basis.Banks will hold capital for operational risk equal to a fixed percentage of the bank´s average annual gross income over the prior 3 years.The Basel Committee has proposed a fixed percentage equal to 15%.

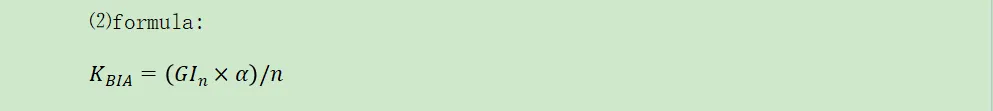

⑵formula:

①GI:annual positive gross income,net interest income+net non-interest income,>0

②α:15%

⑶challenge:

If a bank has negative or zero income for any of the 3 years,then BIA instructs them to revenue those year from both the numerator and denominator when calculating the average revenue(years are not counted).

⑷characteristic:

The BIA to capital is certainly simple to adopt but does little to reflect the operational risk in a firm.

3.Standardized approach(TSA):

⑴definition:

It allows banks to divide activities along standardized business lines within each business line,gross income will be multiplied by a fixed beta factors.The capital charge for operational risk is the sum of each business line´s charges.

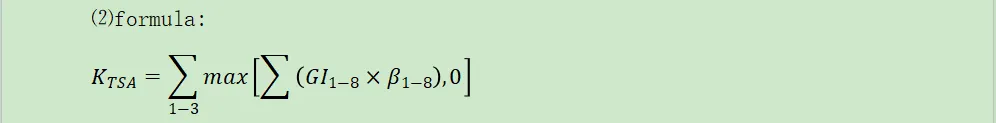

⑵formula:

business lines | beta factors | business lines | beta factors |

corporate finance β1 | 18% | payment and settlement β5 | 18% |

trading and sales β2 | 18% | agency services β6 | 15% |

retail banking β3 | 12% | asset management β7 | 12% |

commercial banking β4 | 15% | retail brokerage β8 | 12% |

⑶challenge:

In any given year,negative capital charge in any business line may offset positive capital charges in other business lines without limit.However,where the aggregate capital charge across all business lines within a given year is negative,then the impact to the numerator for that year will be zero.

⑷another:

alternative standardized approach(ASA):

①definition:

Under the ASA,the operational risk capital charge or methodology is the same as for the standardized approach except for two business lines——retail banking and commercial banking.

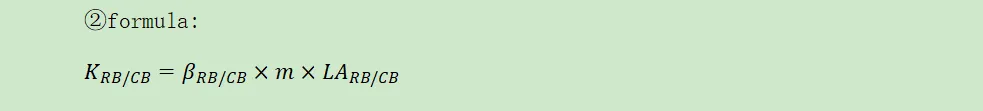

②formula:

A.βRB=12%,βCB=15%

B.m(multiplier)=0.035

C.LARB/CB:total outstanding retail loans and advances,averaged over the past 3 years

·特别注意!

·future of the BIA and TSA:

Pillar 2 provides a mechanism for additional capital requirements to cover any material risks that have not been effectively captured in Pillar 1.

4.Advanced measurement approach(AMA):

⑴definition:

If a bank can meet rigorous supervisory standards,it may use the AMA for operational risk capital calculations:

①The capital charge for AMA is calculated as the bank´s operational value at risk with a 1-year horizon and a 99.9% confidence level.

②Having insurance can reduce this capital charge by as much as 20%.

·特别注意!

·Large banks are encouraged to move from TSA to the AMA in an effort to reduce capital requirement.

⑵main requirements:

There are 3 main requirements:

①The model must hold capital for a 1 year horizon at 99.9 percent confidence level.

②All 4 elements of the framework must be included in the model:

A.internal loss data(at least 5 years) 主要是高频低损事件:

a/ Selecting a loss threshold for loss data collection 门槛值要适度:

△too low:

·It requires a very high amount of reporting.

·Thresholds for collecting loss data should not be set too low if there are business units that have a very large number of smaller losses.

△too high:

It bias the total losses

b/ Selecting internal loss reference data:

To consider in the process of collecting loss data is the timeframe for recoveries,so the data is at least 5 years.

c/ International Accounting Standards Board(IASB)-IAS 37 the loss provisions:

△They are not recognized for future operating losses.

△They are recognized for onerous contracts where the costs of fulfilling obligations exceed expected economic benefits.

△They are only recognized for restructuring costs when a firm has a detailed restructuring plan in place.

△The loss provisions of restructuring costs should not include:

provisions related to relocation of staff,marketing,equipment investment,or distribution investment

B.external loss data:

a/ usage:

△It helps to inform the risk and to control self-assessment activities.

△It provides sample input for scenario analysis.

△It is a required element in AMA capital calculation.

△It will be used to develop key risk indicators that monitor the changing business environment.

b/ categories:

△subscription databases(internal development) 内部建立的外部数据库:

·definition:

The firm gathers and collates information from legal and regulatory sources and media such as news or magazines.

·example:

IBM Algo FIRST:

The most risk event is CPBP.

·特别注意!

·One of the best way is not to spot exact events to be avoided but rather to determine the types of errors and control failings necessary to avoid similar losses.

△consortium data:

·definition:

It gathers anonymous operational risk events from members.

·example:

Operational Risk Data Exchange Association(ORX)

△vendors 其他数据供应商:

The loss threshold is much higher,the information may not always be accurate.

c/ limitations:

△must be viewed with caution

△suffer from collection biases

△do not report all events(reporting bias)

△difficult to determine whether an event is relevant

△the use of benchmarked data relies on the quality of the underlying data

C.scenario analysis:

a/ estimation:

These scenarios estimates are usually gathered through expert opinions.

b/ approaches:

△structured workshops

△surveys

△individualized discussions

c/ limitations:

presentation bias,availability bias,confidence bias,huddle(anxiety) bias,gaming and inexpert opinion,over or under confidence bias,context bias(framing bias)

D.business environment internal control factors:

a/ risk control self-assessment(RSCA):

△assumption:

Controls are assumed to be absent.

△process:

·Identify and access risks associated with each business unit´s

activities.

·Controls are added to the RCSA program to mitigate risks identified for the firm.

·Risk metrics and all other operational risk initiatives are linked to the RCSA program.

·Control tests access that how well the controls in place mitigate potential risks.

△requirement:

It requires the assessment of risks that provides a rating system and control identification process for the operational risk framework.

b/ key risk indicators(KRIs):

They are used to quantify the quality of the control environment with respect to specific business unit process.

c/ business and control environment programs

d/ others:

such as systems,information security,people,execution processing

③These must be an appropriate method for allocating the capital to the business to intent good behavior.

⑶quantitative stipulations:

There are several important quantitative stipulations:

①The model must represent the operational risk framework as outlined in Basel Ⅱ.

②The model must capture all expected and unexpected losses,and may only exclude expected losses under certain strict criteria.

③The model must provide sufficient detail and granularity to ensure fat-tail events are captured.

④The bank must sum all calculated cells or deferred any correlation assumptions that are made in its AMA model.

⑤Reinforces the requirement that all 4 elements must be in the model.

⑥The bank must weight these 4 elements appropriately.

⑷modeling approaches:

①standardized measurement approach(SMA) to modeling operational risk capital:

A.definition:

It represents the combination of a financial statement operational risk exposure proxy and operational loss data specific for an individual bank.

B.revised:

The revised standardized approach is sought to address weakness in the existing standardized approaches:

a/ business indicator(BI):

△The BI is made up of almost the same P&L items that are found in the composition of gross income(GI).

△The BI uses positive values of its components.

△The BI is including:

·interest,lease,dividend component(ILDC)

·services component

·financial component

·provision reversals related to operational loss events

·depreciation tied to operating leases

△The BI is excluding:

·administrative expenses

·insurance premium paid

·depreciation related to capitalized equipment

·impairments & impairments reversals

·provision & reversals of provisions

·expenses tied to share capital repayable on demand

·goodwill changes

·corporate income tax

b/ internal loss multiplier:

It is the relationship between the BI and operational loss exposure is stable and similar for banks with similar values of the BI.

c/ loss component:

It reflects the operational loss exposure of a bank that can be inferred from its internal loss experience.

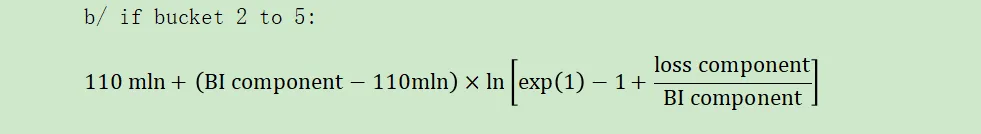

C.formula:

The SMA capital requirement is:

a/ if bucket 1:

BI component

b/ if bucket 2 to 5:

D.characteristics:

The older advanced measurement approach(AMA) allowed banks to use a vast range of models that were inherently more flexible for individual banks,but prevented valuable comparisons among banks.From this,the SMA was created as a non-model-based approach used to assess operational risk using both financial statement measures and loss data unique to individual banks.

·特别注意!

·AMA and SMA are both account for internal losses.

E.regulations:

For identifying,collecting and accounting for operational loss data,the Basel committee has outlined several general and specific criteria that should be used:

a/ key general criteria:

△processes and procedures

△documentation needed

△thresholds for capturing losses

△appropriate periods

b/ specific criteria:

△how to calculate gross loss:

It is excluding:

·total cost of improvement or upgraded enhancement after the risk occurs

·insurance premium

·the costs associated with general maintenance contracts on PP&E

△key dates used to capture the losses

△how to quantify grouped losses

△policies needed

②loss distribution approach(LDA) to modeling operational risk capital:

A.definition:

The LDA is used to meet the Basel Ⅱ operational risk standards for regulatory capital,it relies on internal losses as the basis of its design.

B.characteristics:

a/ It relies on internal losses as the basis of its design.

b/ It uses internal losses as direct inputs with the remaining data elements being used for stressing or allocation purposes.

c/ However,regardless of its model design,a bank must have at least 3 years of loss data to put into its AMA model.

d/ Regulators are learning towards requiring all available data to be included,even beyond the 5-year requirement.

e/ It is widely used in insurance and actuarial science.

C.advantage:

The model is based on real historical data that is relevant to the firm.

D.disadvantage:

a/ The period of data collection is likely to be relatively short.

b/ Historical data does not necessarily reflect the future.(only considering past)

c/ Fat-tail events may not be captured by modeling.

E.categories:

a/ historical-based LDA;

b/ parametric-based LDA:

△step1 modeling frequency:

·definition:

To determine the likely frequency of events on an annual basis.

·approach:

*Most common approach is Poisson distribution.

*The other is negative Binomial distribution.

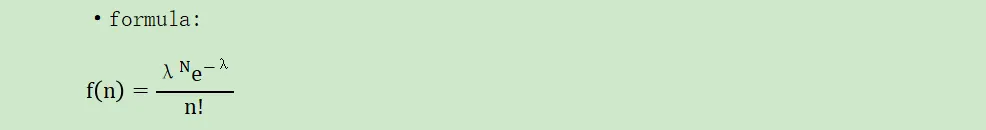

·formula:

*n=1,2,3……

*λ=average number of events in a year

Lower λ produce more skewed and leptokurtic annual loss distributions than higher λ.

△step2 modeling severity:

·definition:

To determine the severity of an event.

·approach:

*Most common approach is lognormal distribution(asymmetrical,fat-tailed).

*The others are Generalized Gamma distribution,Transformed Beta distribution,Generalized Pareto distribution,Weibull distribution.

·characteristics:

suitability——realistic,well specified,flexible,simple

c/ step3 convolution—Monte Carlo simulation:

△It combines frequency and severity distributions:

·A data point is selected from the frequency distribution,and values near the mean of the frequency distribution will be selected more often.

·The size of each of those events is selected from the severity

distribution,and values with a higher probability in the severity

distribution will be selected more often.

·In Monte Carlo simulation,the maximum annual loss is with 99.9% certainty.

△It is to produce additional data points that have the same characteristics as observed data points:

·We make random draws from the loss frequency data and then draw those vents from the loss severity data.

·Each combination of frequency and severity becomes a potential loss event in our loss distribution.

·This process is continued several thousand times to create the potential loss distribution.

F.correlation:

Correlation assumptions must be strongly deferred.

G.dependence:

There are several types of dependencies:

a/ within-cell dependencies

b/ between-cell dependencies

H.copula:

Copula functions can model the dependency of frequency distributions and Gaussian copulas are often used.

③scenario analysis approach to modeling operational risk capital:

A.definition:

A pure scenario analysis approach to modeling uses only scenario analysis data in the model.The other 3 required elements are stress testing,validation and allocation.

B.usage:

It is designed to identify fat-tail events and is useful in calculating the appropriate amount of operational risk capital.

C.advantage:

The data reflects the future as it is captured in a process that is designed to consider "what if" scenarios.

D.disadvantage:

a/ The data is highly subjective.

b/ It produces only a few data points.

c/ The lack of data can make the fitting of distributions troublesome.

d/ The defense of all assumptions must be particularly robust.

E.characteristic:

There may well be cells in the model that rely on a pure scenario analysis model simply because there is little or no loss data available in that cell.

④hybrid approach to modeling operational risk capital:

LDA+scenario analysis:

Loss data and scenario analysis output are both used to calculate operational risk capital.

⑤parametric approach to modeling operational risk capital:

extreme value theory(EVT):

A.importance:

Estimating extreme values is important since they can be very costly.The challenge is that since they are rare,many have not been observed.Thus,it is difficult to model them:

a/ Central limit theorems do not apply to extremes.

b/ Extremes are governed by extreme-value theorems.

c/ It can be used to model extreme events in financial markets and to compute VaR and ES.

B.methods:

a/ Block Maxima method:

generalized extreme value(GEV) distribution:

△parameters:

location(μ),scale(σ),shape/tail(ξ)+select threshold(u)

△theorem:

Fisher-Tippett theorem:

When the sample size is increasing,the distribution of extremes converges to the GEV distribution.

△threshold:

·high enough so that the GPD(generalized Pareto distribution) applies(more applicable)

·low enough so that there are sufficient observations

·特别注意!

·Increasing the tail parameter will increase both VaR & ES.

·Decreasing the β will decrease both VaR & ES.

·Increasing the loss threshold level will increase both VaR & ES.

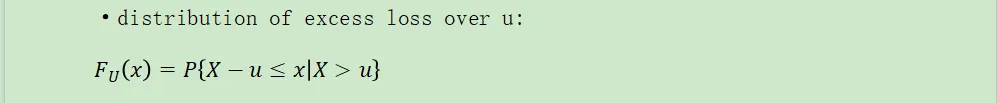

b/ peaks over threshold(POT) method:

△definition:

It is an application of EVT.It models the values that occur over a given threshold.

△assumption:

It assumes that observations beyond the threshold follow a generalized Pareto distribution whose parameters can be estimated.

△distribution:

generalized Pareto distribution:

·parameters:

positive scale(β),shape/tail(ξ)+select threshold(u)

·technique:

Using maximum-likelihood technique

·distribution of excess loss over u:

c/ comparison(POT vs. GEV):

△the same:

They have the same goal,and are built on the same general principles of EVT,share the same shape/tail parameter(ξ).

△the different:

·POT advantage:

GEV involves an additional parameter and involves some loss of useful data.

·POT disadvantage:

It has the problem of choosing the threshold.

C.multivariation:

a/ reason:

Extreme events are net independent.

b/ categories:

△ρ:

normal(elliptical) distribution

△copulas:

非线性,not normal

c/ importance:

△It is important because many extreme values the dependent on each other,and elliptical distribution analysis and correlations are NOT useful in the modeling of extreme values for multivariate distributions.

△Modeling multivariate extremes requires the use of copulas.

△Given that more than one variable is involved,modeling those extremes can be even more challenging because of the rarity of multiple extreme values occurring at the same time.

5.Insurance:

The recognition of insurance mitigation is limited to 20 percent of the total operational risk capital change calculated under the AMA.

6.Disclosure:

⑴Capital amounts and the factors used must be disclosed under Pillar 3 of Basel Ⅱ.

⑵Whatever approach is taken to modeling capital for operational risk,the model must be stress tested and back tested for validity,and it is expected that models will continue to evolve as experience develops.

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift

Topic 15 The Art of Term Structure Models:Volatility and Distribution

Topic 16 Overnight Index Swap(OIS) Discounting

B.Credit Risk

B.信用风险

Topic 20 Default Risk:Quantitative Methodologies

Topic 21 Credit Risks and Credit Derivatives

Topic 22 Credit and Counterparty Risk

Topic 23 Spread Risk and Default Intensity Models

Topic 25 Structured Credit Risk

Topic 26 Defining Counterparty Credit Risk

Topic 27 The Evolution of Stress Testing Counterparty Exposures

Topic 28 Netting,Compression,Resets,and Termination Features

Topic 32 Default Probability,Credit Spreads and Credit Derivatives

Topic 33 Credit Value Adjustment(CVA)

Topic 35 Credit Scoring and Retail Credit Risk Management

Topic 38 Understanding the Securitization of Subprime Mortgage Credit

C.Operational Risk

C.操作风险

Topic 39 Principles for the Sound Management of Operational Risk

Topic 40 Enterprise Risk Management:Theory and Practice

Topic 41 Observations on Developments in Risk Appetite Frameworks and IT Infrastructure

Topic 42 Operational Risk Data and Governance