大浩浩的笔记课堂——FRM考试学习笔记092

- 2026-01-12 11:54:15

Topic 21 Credit Risks and Credit Derivatives

1.Credit risks as options:

⑴background:

①A value-based model where the value of the firm´s outstanding debt plus equity is equal to the value of the firm—V=D+E

②The value of the debt can serve as an indicator of firm default risk.

③There is an assumption that lognormal distribution and constant variance are for changes in firm value.

⑵Merton model:

①formulas:

A.ST=max(VT-D,0)

Equity is similar to a long call option on the value of a firm´s assets where face value of debt is the strike price of the option.

B.DT=D-max(D-VT,0)

Debt is similar to a risk-free bond and short put option on the value of a firm´s assets where face value of debt is the strike price of the option.

②notes:

A.ST:the value of equity at date T

B.VT:the value of the firm

C.D:the principal amount of the debt

D.DT:the value of debt at date T

⑶finding firm value and firm value volatility:

①Equity is a call option on the value of the firm:

S(V,F,T,t)=C(V,F,T,t)

②Equity is more volatile when firm value is low than when it is high,so that volatility falls as firm value increases.

即equity与volatile成正比。

⑷subordinated debt:

①volatility:

Senior debt always falls in value when firm volatility increases,but an increase in firm volatility makes it more likely increases the value of subordinated debt.

②formulas:

A.V=D(V,F,T,t)+SD(V,U,T,t)+S(V,F+U,T,t)

a/ D:senior debt

b/ F:face value

c/ SD:subordinated debt

d/ U:face value

B.S(V,F+U,T,t)=C(V,F+U,T,t);D(V,F,T,t)=V-C(V,F,T,t)→

SD(V,U,T,t)=V-S(V,F+U,T,t)-D(V,F,T,t)=V-C(V,F+U,T,t)-[VC(V,F,T,t)]=C(V,F,T,t)-C(V,F+U,T,t)

即the value of subordinated debt is the difference between the value of an option on the value of firm with the exercise price F+U and an option on the value of the firm with the exercise price F.

③value changes:

A.changing functions:

a/ Subordinated debt is almost similar to equity and its value is an increasing function of the volatility of the firm.

·特别注意!

·experiencing financial distress→low firm values

b/ Alternatively,if the firm is unlikely to ever be in default,then the subordinated debt is effectively like senior debt and inherits the characteristics of senior debt.

·特别注意!

·Not experiencing financial distress→high firm values

B.changing factors:

a/ The value of subordinated debt can fall as time to maturity decreases.

b/ The value of subordinated debt can increase as a rise in interest rates.

·特别注意!

·Vulnerable options are options with positive probability of default,such as counterparty risk.

2.Beyond the Merton model:

The difficulties of the Merton model:

⑴When debt makes coupon payments or a firm has multiple debt issues that mature at different dates.

⑵Default is too predictable,but in the real world,default is often more surpring because the firm value can jump.

3.Credit risk models:

⑴credit spread(CS):

①definition:

It is the difference between the yield on a risky bond(e.g.corporate bond) and the yield on a risk-free bond(e.g.T-bond) given that the two instruments have the same maturity.

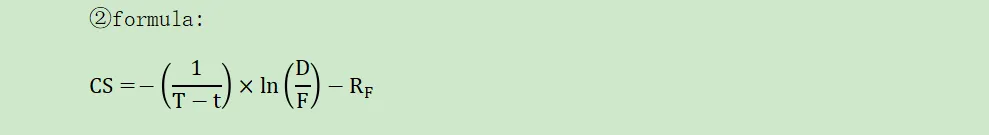

②formula:

A.D:current value of debt

B.F:face value of debt

⑵credit risk+ model:

①assumption:

specific functional form

②definition:

It determines default probability correlations and default probabilities by using a set of common risk factors for each obligor.

③characteristics:

A.Each obligor has its own sensitivity to each of the common risk factors.

B.The model allows for only two outcomes(default or non-default) for a loss of a fixed size.

C.The model assumes that defaults are uncorrelated across obligors.

D.It does not use non-parametric methods.

④default:

A.the conditional probability of default:

The probability of default given the realizations of the risk factors.

B.the unconditional probability of default:

a/ definition:

The probability obtained if we do not know the realizations of the risk factor.

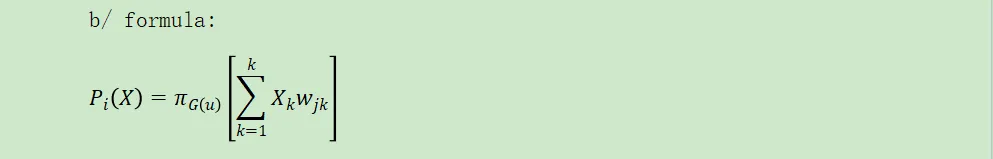

b/ formula:

其中ΠG(u):

unconditional probability of default for obligor i given that it belongs to grace G.

⑤advantage:

It is easy to use.

⑶credit metrics approach:

①definition:

It uses historical data to estimate the probability of a bond being upgraded or downgraded using historical transition matrices.

②steps:

Steps in calculating credit VaR using credit metrics approach:

A.Determine rating class for debt claim.

B.Use historical rating transition matrix to determine the probability that claim will migrate.

C.Estimate the distribution of value for claim by computing the expected values for 1 year.

D.Use the 1-year forward zero curves rates to get current price of zero-coupon bond.

E.Assume annual coupons to compute value of bond for each possible rating for next year.

F.Compute the expected bond value then compute the credit value at risk(VaR) for a given confidence level.

③usage:

A.It is used for determining the credit VaR for large portfolios of debt claims.

B.A typical VaR measure would be use the fifth percentile of the bond price distribution.

④difficulty:

The major difficulty is computing the joint distribution of the migrations of the bonds in the portfolio.

⑤the way:

A.using historical estimates

B.proposing an approach based on stock returns(time consuming)

⑷the KMV model:

①definition:

A.It uses the "expected default frequency" for each obligor from an extension of equation.

B.Default probability is a function of firm asset growth and the level of debt:

The higher the growth and lower the debt level,the lower the default probability.

②advantages:

The use of current equity values:

A.Any event that affects firm value translates directly into a change in the probability of default,so the impact of a current event to immediately affect the probability of default.

B.Ratings changes occur with a considerable lag.

C.Probabilities of default change continually as equity value change rather than only when ratings change.

D.Simulation is not needed to compute.

E.It includes an estimate of correlation between firm values based on the correlation between observed equity values.

·特别注意!

·The KMV model is better than the credit metrics approach because in the credit metrics approach,the value of the firm change without any impact on the probability of default.

⑸credit portfolio view model:

①definition:

It is multifactor model for simulating joint conditional distributions of credit migration and default probabilities that incorporates macroeconomic factors.

②characteristics:

A.It models the transition matrices using macroeconomic or economic cycle data.

B.It estimates an econometric model for an index that drives the default rates of an industrial sector.

③steps:

A.Measuring the autoregressive process of the macroeconomic variables.

B.Composing sector indices for the variables.

C.Estimating a default rate based on the value of that index.

D.Comparing the simulated values to historical values to determines the transition matrix.

④difficulties:

A.It does not take into account changes in interest rates or credit spreads.

B.It can not take into account changing economic conditions.

·特别注意!

·These models attempt to estimate a portfolio´s credit VaR.It differs from market VaR in that it measures losses that are due specifically to default risk and credit deterioration risk.

·特别注意!

·the comparison of credit risk models:

credit risk+ | credit metrics | Moody´s KMV | credit portfolio view | |

originator | Credit Suisse | JP Morgan | Moody | McKinsey |

model type | bottom-up | bottom-up | bottom-up | top-down |

risk definition | default losses (DM) | market value (MtM) | default losses (MtM/DM) | market value (MtM) |

risk drivers | default rates | asset values | asset values | macro factors |

credit events | default | rating change/default | continues default probability | rating change/default |

probability | unconditional | unconditional | conditional | conditional |

volatility | variable | constant | variable | variable |

correlation | default process (reduced-form) | from equities (structural) | from equities (structural) | from macro factors |

recovery rates | constant within band | random | random | random |

solution | analytic | simulation/analytic | analytic | simulation |

·the advantages of credit risk models:

Models have made improvements at estimating the probability of default.

·the limitations of credit risk models:

*The models do not account for changes in interest rates,credit spreads and current economic conditions.

*The models that use historical correlations are not able to account for changing economic conditions.

4.Credit derivatives:

⑴definition of credit derivatives:

①They are financial instruments whose payoff are contigent on credit risk realizations because they are designed as hedging instruments for credit risk and they are usually traded OTC.

·特别注意!

·the significant risk when hedging with CDS contract:

There is an economic loss,but the credit event in the contract is not triggered.

②They are contracts with payoffs on a specified credit event.

⑵the types of credit event:

①bankruptcy 破产(defined by ISDA):

A.定义:

其是指个人或者企业因无力支付各种债务而导致无法继续经营的情境。

B.情形:

a/ dissolution of the obligor(other than merger)

b/ insolvency or inability to pay its debt

c/ assignment of claims

d/ institution of bankruptcy proceeding

e/ appointment of receivership

f/ attachment of substantially all assets by third party

②failure to make a required payment 支付失败(defined by ISDA):

A.fail to pay principal or interest

B.fail to make a collateral posting

③obligation/cross acceleration 交叉加速(defined by ISDA)

④obligation/cross default 交叉违约或者连带违约(defined by ISDA)

⑤repudiation 拒付(defined by ISDA)

⑥moratorium 延期支付(defined by ISDA)

⑦restructuring 重组(defined by ISDA):

This covers the restructuring of debt causing a material adverse change in creditworthiness.

⑧others(not defined by ISDA):

downgrading,currency inconvertibility,governmental action.

⑶types of credit derivatives:

①first-to-default put(the simplest credit derivative):

A.CDS variation where a party pays an insurance premium in exchange for being made whole for the first default from a basket of assets.

B.It is more cost effective option than CDS if assets have uncorrelated default risks.

②credit default swap(CDS):

It is like insurance,party selling the protection receives a fee,and pays based on swap´s notional amount in the case of default.

·特别注意!

·For a bank,CDS likes put option on the reference obligation(limits downside risk).

·long corporate bond=long risk-free bond+short credit default swap(CDS)(short put option on the firm value)

③total return swap(TRS):

A.definition:

Total return on an asset(bond) is exchanged for a fixed(or variable) payments.

a/ The protection buyer(total return payer,or risk seller) pay the total return(interest or coupon+price appreciation) on reference obligation(loan,bond,stock,even a portfolio of assets),receive

LIBOR+spread+price depreciation and exchange credit risk of issuer defaulting for the combined risk of the issuer and the derivative counterparty.

b/ The protection seller(total return receiver,or risk buyer) exposed to credit and interest risk and gets any appreciation(capital gains and cash flows),pays any depreciation payments take place whether or not a credit event occurs.

B.risks:

a/ Both market risk and credit risk are transferred from the risk seller to the risk buyer.

b/ There is counterparty risk in total return swaps.

④vulnerable option:

A.definition:

Option with default risk,holder of the option receives promised payment only if seller of the option is able to make the payment(The value of the counterparty firm is greater than the required payment on the option).

B.payoff:

max[min(V,S-X),0]

C.correlation:

The correlation between the value of the firm and the underlying asset value:

a/ If the correlation is strongly negative:

The vulnerable option has little value.

b/ If the correlation is strongly positive:

There is no credit risk.

D.formula:

Vulnerable option=[(1-PD)×C]+(PD×RR×C)

⑤credit-linked note:

A.definition:

It is a debt instrument with its coupon and principal risk tied to an underlying debt instrument(bond/loan).

B.characteristic:

It embeds a default swap into a debt issuance.

·特别注意!

·Selling or issuing a CLN transfers credit risk to the investors.

C.process:

Principal is exchanged when a CLN is sold to an investor,although the CLN seller retains ownership of the underlying-debt instrument.

D.specialness:

ABS-CLN:

a/ definition:

It is a debt obligation with a coupon and redemption that are tied to the performance of a bond or loan,or to performance of government debt.

b/ function:

It gets exposure to the loan without actually investing in the loans.

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift

Topic 15 The Art of Term Structure Models:Volatility and Distribution

Topic 16 Overnight Index Swap(OIS) Discounting

B.Credit Risk

B.信用风险

Topic 20 Default Risk:Quantitative Methodologies