大浩浩的笔记课堂——FRM考试学习笔记088

- 2026-01-09 18:06:26

Topic 17 Volatility Smiles

1.The definition of volatility smile:

It is a plot of the implied volatility of an option with a certain life as a function of its strike price.

2.Why the volatility smile is the same for calls and puts:

⑴P+S0·e-qT=C+ke-rT:

put-call parity (whatever pricing model is used)

⑵PBS-Pmkt=CBS-Cmkt:

The dollar pricing error when the BSM model is used to price a European put option should be exactly the same as the dollar pricing error when it is used to price a European call option with the same strike price and time to maturity.

⑶The correct volatility(volatility smile/volatility surface) is the same for European calls and European puts.(The puts and calls are from BSM model.)

⑷The "sticky strike rule" assumes that implied volatility is the same for short time periods.

3.The volatility smile of options:

⑴foreign currency options:

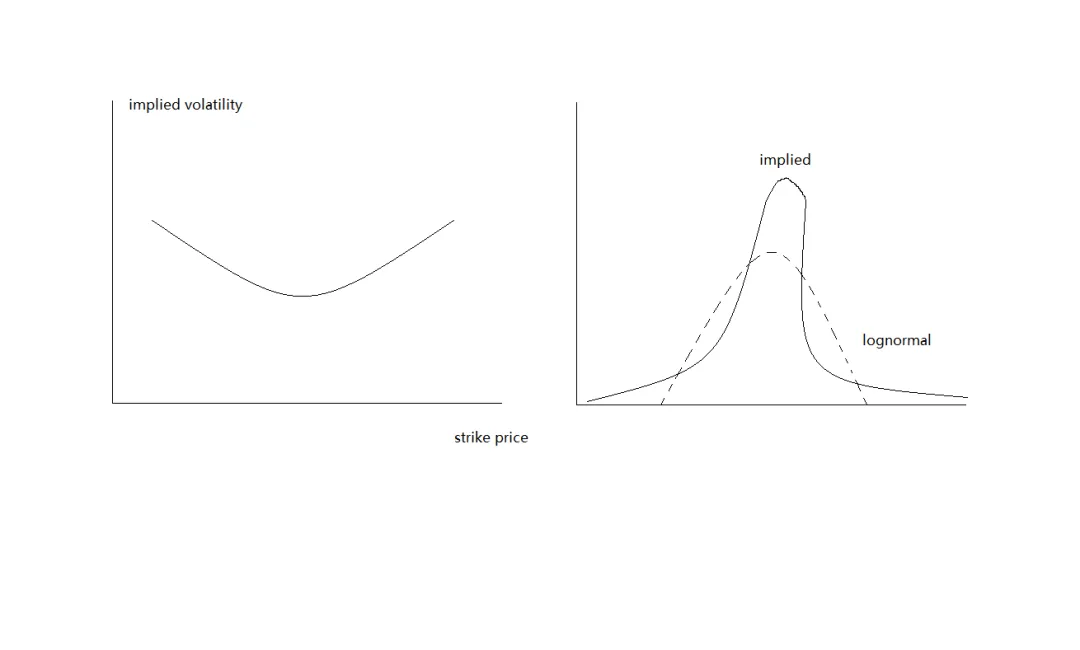

①graph:

②characteristics:

A.Implied volatility is lower for at-the-money options than it is for away-from-the-money options.

B.If the implied volatilities for actual currency options are greater for away-from-the-money than at-the-money options,currency trades must think there is a greater chance of extreme price movements than predicted by a lognormal distribution.

C.Both out-of-the-money or in-the-money options have higher implied volatilities than at-the-money options.

③reasons:

A.why are exchange rates not lognormal distributed:

a/ conditions for an asset price to have a lognormal distribution:

△The volatility of the asset is constant.

△The price of the asset changes smoothly with no jumps.

b/Neither of those is satisfied for an exchange rate:

Volatility of an exchange rate is far from constant,and exchange rates frequently exhibit jumps.

B.The impact of jumps and nonconstant volatility depends on the option maturity.

C.The result of all this is that the volatility smile becomes less pronounced as option maturity increases.

⑵equity options:

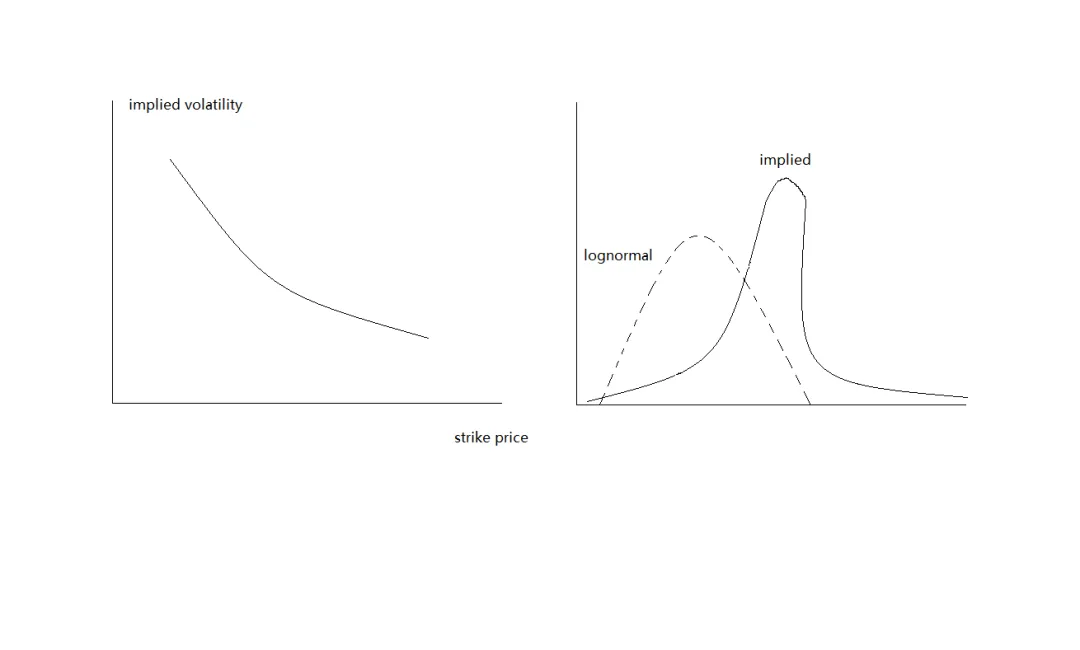

①graph:

②characteristics:

A.Higher implied volatility for low strike price options.The volatility smirk(half-smile) exhibit by equity options translate into a left-skewed implied distribution of equity price changes.

B.the implied distribution:

volatility skew:

a/It has a heavier left tail less heavy right tail than the lognormal distribution.

b/This indicates that traders believe the probability of larger down movements in price is greater than large up movements in price,as compared with a lognormal distribution.

③reasons:

A.It concerns leverage:

As a company´s equity declines in value,the company´s leverage increases,so the riskiness or volatility of the underlying assets increases.

B."crash euphoria":

a/ 1987 stock market crash→higher premiums for put price when the strike prices lower

b/ It is based on the idea that large price declines are more likely than assumed in BSM prices.

4.The impact of large asset price jumps:

Implied volatility is affected by price jumps and the probabilities assumed for either a large up or down movement:

⑴At-the-money options tend to have a higher implied volatility either out-of-the-money or in-the-money options.

⑵Away-from-the-money options exhibit a lower implied volatility than at-the-money options.

·特别注意!

·The implied volatility increases as the asset price increases.

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift

Topic 15 The Art of Term Structure Models:Volatility and Distribution

Topic 16 Overnight Index Swap(OIS) Discounting