大浩浩的笔记课堂——FRM考试学习笔记108

- 2026-02-07 21:11:57

Topic 37 An Introduction to Securitization

1.The concept of securitization:

⑴securitization:

①definition:

It refers to the sale of assets,which generate cash flows from the institution that owns the assets,to another company that has been specifically set up for the purpose of acquiring them,and the issuing of notes by this second company.

②characteristic:

It allows institutions(banks,corporates) to convert assets that are not really marketable(residential mortgages or car loans) into rated securities that are tradable in the secondary market.

⑵special purpose vehicle(SPV):

①definition:

A.It is a legal trust or company that is not for legal purposes,linked in any way to the originator of the securitization.

B.It is a bankruptcy-remote legal entity designed to hold structured products.

②purposes:

The most common purpose for SPV:

A cash flow securitization,in which the sponsoring company sells assets off its balance sheet to the SPV,which funds the purchase of these assets by issuing notes.

③characteristics:

A.The default of an SPV could cause default for the originator as well.

B.It is used to separate the assets from the originator and customize the products for investors.

C.Because SPVs are not subject to the same capital requirements as banks,an originating bank is able to reduce capital requirements by selling assets to an SPV.

④usages:

SPVs are also used for the following applications:

A.Converting the currency of underlying assets into another currency more acceptable to investors.

B.Issuing credit-linked notes(CLNs).

C.They are used to transform illiquid into liquid ones.

⑤categories:

A.trust→U.S. market

B.company/corporation→Euro market

⑥structures:

A.amortizing structure:

a/ Principal and interest payments are made on an amortizing schedule to investors over the life of the product(residential mortgages,commercial mortgages,and consumer loans).

b/ Because payments are made as coupons are received,this type of structure is referred to as a pass-through structure.

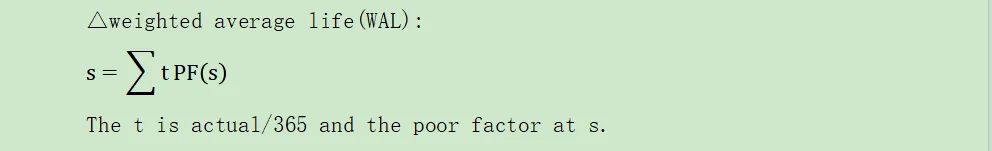

c/ valued based on the expected maturity & the weighted-average life(WAL)

B.revolving structure:

a/ Principal payments of the assets are paid in large lump sums rather than a pre-specified amortization schedule because the credit card debt and auto loans have short time horizon and high rate of pre-payments.

b/ Under a revolving structure,payments are not simply passed through.Rather,principal payments are often used to purchase new receivables.

·特别注意!

·The difference in how payments are received from the underlying collateral over the ABS´s life.

C.master trust structure:

a/ A master trust structure allows an SPV to make frequent issues or multiple securitizations.

b/ The master trust structure enables the SPV to issue multiple ABS through the single trust.

c/ The ability of SPV master trust structures to sell multiple issues to investors that share excess spreads over these multiple series.

⑶derivative product company(DPC):

①definition:

It is setup very similarity to an SPV,but it is one more step from removed for the originator to help isolate risk in default scenario.

②credit rating for DPC:

A.minimizing market risk

B.support from the originator

C.internal credit risk management guidelines

⑷monoline insurance company:

①It provides insurance for only one type of product.

②Default on insured products could create a going-concern issue for monolines.

2.Reasons for undertaking securitization:

⑴reasons:

①funding the assets it owns:

A.support rapid asset growth

B.diversify their funding mix and reduce cost of funding

C.reduce maturity mismatches

②balance sheet capital management:

A.regulatory capital relief(SPV is not bank.)

B.economic capital relief

C.diversified sources of capital

③risk management:

Credit risk exposure is reduced because the assets have been soled to the SPV.

⑵benefits:

benefits of securitization to investors:

①diversify sectors of interest:

The pooled assets have lower concentration risk.

②access difficult risk-reward profiles:

The originator holds the first-loss piece in the structure.

③access sector that are otherwise not open to them

3.The process of securitization:

⑴securitization note tranching:

①the most senior tranches:

The most senior tranches at the top of the capital structure will have the highest priority to receive principal and interest and earns a relatively low fixed coupon.

②the mezzanine tranche:

Between the senior and equity tranche is the mezzanine tranche(i.e.,the junior tranche).The mezzanine tranches will absorb losses only after the equity tranche is completely written down.(purposely thin)

③the equity tranche:

The equity tranche is the slice of the cash flow distribution with the lowest priority and will absorb the first losses up to a prespecified level:

A."Thinnest tranche",do not carry a fixed coupon but receive the residual cash flows only after the other claims are satisfied.

B.It is often held by the originator.

⑵credit enhancements:

①This is usually by some or all of the following methods:

A.external credit enhancement:

insurance or wraps:

It is an insurance policy or wraps purchased from a third party to cover the risk of principal loss in the collateral pool.

B.internal credit enhancement:

a/ over collateralization(hard credit enhancement):

△the nominal value of the assets in poll>nominal value of issued securities

△The lowest class of notes are often over collateralized.

b/ excess spread:

△the liability side of the SPV<the asset side of the SPV:

·the liability side of the SPV cost:

weighted average of the payment promised to the senior,junior and equity tranches

·the asset side of the SPV cost:

weighted average of the collateral

△This is the difference between the return on the underlying assets and the interest rate payable on the issued notes.

△If there are no future losses,the remaining excess spread is returned to originator.

c/ subordinatingnote classes(tranches);

d/ margin step-up:

△It is sometimes used by an ABS where the coupon structure increases after a call date.

△It provides investors with an extra incentive to invest in the issues.

②cash flow waterfall(pricing of payments):

collateral pool interest proceeds | ||

↓ | ||

trustee and administration fees | ||

↓ | ||

interest on class A senior notes | ||

↓ | ||

"A"coverage tests | ||

↓pass | ↓fail | |

interest on class B notes | principal on class A notes | |

↓ | ↓ | |

"B"coverage tests | principal on class B notes (if A notes fully redeemed) | |

↓pass | ↓fail | ↓ |

interest on class C notes | principal on class A notes | principal on class C notes (if B notes fully redeemed) |

↓ | ↓ | ↓ |

equity tranche returns | principal on class B notes | residual on subordinate notes |

A.three-tiered securitization structure:

a/ inflows:

△inflows prior to maturity

=interest on the collateral+the recovery from the sale of any defaulted assets in the current period

△terminal cash flows in the final year

=last interest payment+principal and recovery of defaulted assets

△the value of OC at end of final year

b/ outflows:

The outflows=the coupon payments paid to (senior+mezzanine) note holder

·特别注意!

·A third party is often hired to run tests to ensure cash flows are sufficient to pay all outstanding liabilities.

·If the cash flows to equity holders exceed the overcollateralization trigger the excess is diverted to a trust account.Fees and defaults will reduce the net cash flows available for distribution.

B.the following steps to determine the cash flow to equity:

Is the current period interest sufficient to cover the promised coupons(Lt≥B):

a/ if yes:

Then the following overcollateralization test must be performed to see(Lt-B≥K):

△if yes,then K is diverted to trust(OCt=K),and (Lt-B-K) flows to equity holders.

△if no,then (Lt-B) is diverted to trust(OCt=Lt-B),and nothing flows to equity holders.

b/ if no:

Then the interest is not sufficient to pay bondholders and all Lt flows to bondholders.

Therefore,the shortfall is (B-Lt) (using trust account if it has enough funds or suffer a write down).

⑶impact on balance sheet:

Selected assets have been removed from the balance sheet,although the originating bank will usually have retained the first-loss piece with the regard to the regulatory capital impact,this first-loss amount,is deducted from the bank´s total capital position.

4.ABS structures:a primer on performance metrics and test measures:

⑴growth of ABS/MBS;

⑵collateral types:

①ABS performance is largely dependent on consumer credit performance.

②to safeguard against poor portfolio:

A.trigger mechanisms→to accelerate amortization

B.reserve accounts→to cover interest shortfalls

③some prominent asset classes:

A.auto loan:

a/characteristics:

Vehicle is easily sellable,tangible,prepayment speed is extremely stable,losses are relatively low.

b/ performance analysis:

△the main indicator:

loss curves(show expected cumulative loss)

△the absolute prepayment speed(APS):

standard measure for prepayment,indicates the expected maturity of the issued ABS

·特别注意!

·the APS→prepayments/outstanding pool balance

B.credit card:

a/ the difference from other type of ABS:

△Loans have no predetermined term(repaid within 6 months).(revolving structure)

△Repayment speed needs to be controlled.

b/ The Master Trust structure allows an issuer to sell multiple issues for a single trust and from a single albeit changing,pool of receivables.

c/ excess spread:

The high yield on credit card debt compared to is card issuer´s funding costs.

d/ performance analysis for credit card ABS:

△delinquency ratio:

receivables overdue for more than 30 days

·特别注意!

·delinquency ratio→past due receivables/outstanding pool balance

△default ratio:

receivables written off

·特别注意!

·default ratio→defaults/outstanding pool balance

△monthly payment rate(MPR):

·The proportion of the principal and interest on the pool that is repaid in a particular period.

·Set a minimum MPR as a trigger for early collection.

·特别注意!

·MPR→receivables collected/outstanding pool balance

C.mortgages(MBS):

a/ agency and non-agency MBS:

△agency MBS:

pass-through:

Investors are simply purchasing a share in the cash flow of the underlying loans.

△non-agency MBS:

A senior and a tranched subordinated class with principal losses absorbed in reverse order.

b/ RMBS and CMBS:

CMBS→non-recourse loan:

It is fully secured by the underlying property assets.

c/ performance analysis for MBS:

△debt service coverage ratio(DSCR):

DSCR=net operating income(NOI)/debt payments(2.5-3.0)

△weighted coverage coupon(WAC):

compared to the net coupon payable to investors

△weighted average maturity(WAM):

It is the average weighted of the remaining terms to maturity of the underlying pool of mortgage loans in the MBS.

△weighted average life(WAL):

D.forecasting prepayment levels:

a/ usage:

They are used to estimate prepayments for student loans and mortgages.

b/ approach/method:

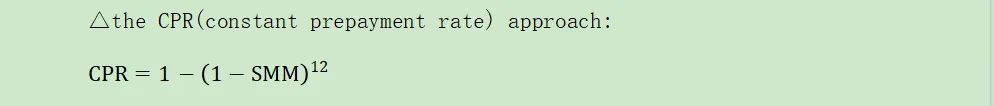

△the CPR(constant prepayment rate) approach:

SMM(single monthly mortality) is the single-month proportional prepayment.

·特别注意!

·SMM→prepayment/outstanding pool balance

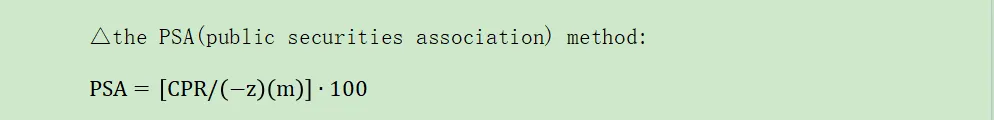

△the PSA(public securities association) method:

·特别注意!

·The PSA typically assumes that prepayments will increase as a pool approaches maturity.The MBS pool of mortgages has a 100% PSA of its CPR begins at 0 and increases 0.2% each month for the first 30 months.

·特别注意!

·The key difference between the structure of CDOs and ABSs is the number of underlying loans:

CDO:≤200 loans,ABS:greater diversify with thousands of obligors

·Key factors that led to the loss in market confidence and the financial crisis of 2007 to 2009 include:

credit crunch,shadow banking system,leverage,lack of transparency,credit rating agencies´ practices,accounting and liquidity

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift

Topic 15 The Art of Term Structure Models:Volatility and Distribution

Topic 16 Overnight Index Swap(OIS) Discounting

B.Credit Risk

B.信用风险

Topic 20 Default Risk:Quantitative Methodologies

Topic 21 Credit Risks and Credit Derivatives

Topic 22 Credit and Counterparty Risk

Topic 23 Spread Risk and Default Intensity Models

Topic 25 Structured Credit Risk

Topic 26 Defining Counterparty Credit Risk

Topic 27 The Evolution of Stress Testing Counterparty Exposures

Topic 28 Netting,Compression,Resets,and Termination Features

Topic 32 Default Probability,Credit Spreads and Credit Derivatives

Topic 33 Credit Value Adjustment(CVA)

Topic 35 Credit Scoring and Retail Credit Risk Management