大浩浩的笔记课堂——FRM考试学习笔记118

- 2026-02-07 12:56:34

Topic 47

Risk Capital Attribution and Risk-Adjusted Performance Measurement

1.Risk capital(economic capital):

⑴risk capital vs. regulatory capital:

risk capital(economic capital) | regulatory capital | |

definition | 1.Risk capital provides protection against risk.It can be defined as a financial buffer to shield as a fence from the economic impacts of the risks that it takes 2.In short,it provides assurance to the firm´s stakeholders that their invested funds are safe | Regulatory capital is computed using general benchmarks that apply to the industry.The result is a minimum required amount of capital adequacy |

features | 1.as a buffer to cover unexpected losses 2.target level of solvency 3.the use of internal models 4.It compares the different risks incurred by a firm,across different businesses and activities,different types of risk which including market risk,credit risk and operational risk 5.不同银行之间不可对比 | 1.It is relevant only for regulated industries such as banking and insurance 2.Assuming that risk capital and regulatory capital are the same for the overall firm,the amounts may be different within the various divisions of the firm |

calculation | 1.It is the amount of funds that the firm must hold in reserve to cover a worst-case loss 2.However,strategic risk capital may be added to economic capital: economic capital=risk capital+strategic risk capital | Using general benchmarks that apply to the industry |

⑵to allocate risk capital:

For financial institutions,there are 4 major reasons for using economic capital to allocate risk capital:

①Capital is used extensively to cushion risk.

②Financial institutions must be creditworthy.

③Difficulty in providing an external assessment of a financial institutions creditworthiness.

④Profitability is greatly impacted by the cost of capital.

⑶to diversify risk capital:

①aggregating a firm´scapital:

A.The overall risk capital for a firm should be less than the total of the individual risk capitals.

B.Risk reduction due to diversification effects is very difficult to

measure.

②allocating economic capital to different business lines:

A.A business unit that are highly correlated to the overall firm need to be allocated more risk capital.

B.Having business lines that are counter cyclical in nature allows the overall firm to have stable earnings and to attain a given desired credit rating using less risk capital.

·特别注意!

·It is therefore common practice to adjust for the diversification effects by lowering the confidence level(99.97%→99.5% or lower) used a the business level.

③There are 3 different measures of risk capital:

A.stand-alone risk capital:

a/ definition:

It is the risk capital calculated without any diversification benefits.

b/ formula:

the sum of the stand-alone capital of the individual≥stand-alone risk capital of the total business unit

·特别注意!

·Most institutions allocate the portfolio effect pro rata with stand-alone risk capital.

B.fully diversified risk capital:

The capital attributed to each actively X and Y,taking into account all diversification benefits from combining them under the same leadership.

C.marginal risk capital:

It is the additional risk capital required by an incremental deal,activity,or business.It takes into account the full benefit of diversification.

④The choice of risk capital measure depends on the objectives:

A.stand-alone risk capital:

incentive compensation

B.fully diversified risk capital:

a/ Assessing the solvency of the firm and minimum risk-pricing.

b/ Assessing the extra performance generated by the diversification effects.

C.marginal risk capital:

active portfolio management or business mix decision

2.Risk-adjusted return on capital(RAROC):

⑴definition:

The RAROC measure is essential to successful integrated risk management.Its main function is to relate the return on capital to the riskiness of firm investments.

⑵characteristics:

①It uses economic profits.

②If it is below the cost of equity,there is no value being added.

③It has the flexibility to consider deferred or contigent compensation.

④A restriction on the firm´s growth due to leverage limitation may result in higher profits.

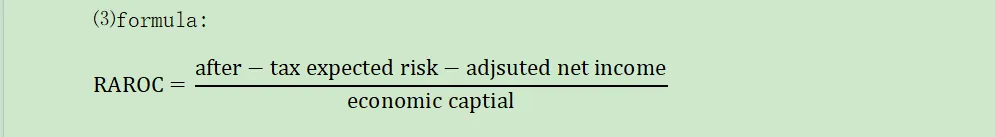

⑶formula:

⑷advantages:

Benefits of using the RAROC approach include:

①performance measurement using economic profits instead of accounting profits

②use in computing increases in shareholder value as part of incentive compensation within the firm and its divisions

③use in portfolio management for buy and sell decisions and use in capital management in estimating the incremental value-added through a new investment or discontinuing an existing investment

④using risk-based pricing,which will allow proper pricing that takes into account the economic risks undertaken by a firm in a given transaction

3.RAROC for capital budgeting:

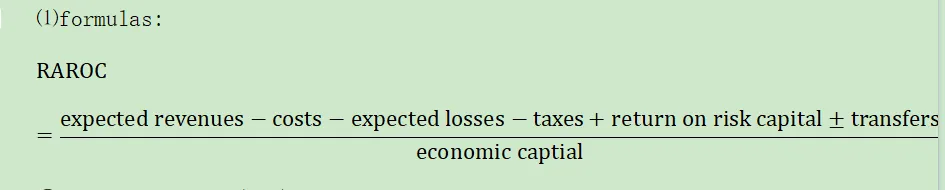

⑴formulas:

①after taxes="×(1-t)"

②return on risk capital=Rfree×economic capital

③economic capital=risk capital+strategic risk capital=unexpected loss=principal amount×unexpected loss rate

④risk capital=credit risk capital+market risk capital+operational risk capital+etc

⑤strategic risk capital=good will+burned-out capital

⑵factors:

①risk capital:

It is the capital arise that the bank must set aside to cover the worst-case loss from market risk,credit risk,operational risk and other risks.

②strategic risk capital:

It is the risk of significant investment about whose success and profitability there is high uncertainty.

③burned-out capital:

It is an allocation of capital to account for the risk of strategic failure of recent acquisitions or other strategic initiatives built organically.

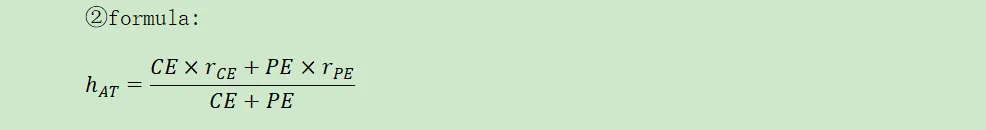

⑶hurdle rate and capital budgeting decision rule:

①characteristic:

The hurdle rate should be reset periodically(6 months),or when it has changed by more than 10 percent.

②formula:

A.CE:common equity

B.PE:preferred equity

③rules:

capital budgeting decision rules:

A.if RAROC>hurdle rate→value creation from the project and accepted

B.if RAROC<hurdle rate→value destruction and rejected/discontinued

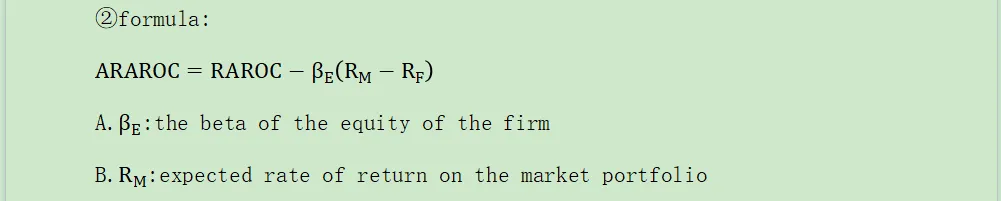

⑷adjusted RAROC:

①definition:

Its measure was developed to better align the risk of the business with the risk of the firm´s equity.

②formula:

③rule:

Accept(reject) projects whose ARAROC is greater(smaller) than RF.

4.RAROC for performance measurement:

⑴RAROC horizon:

①Practitioners usually adopt one-year time horizon:

A.For market risk,short time horizons require adjustments.

B.factor to lower the current risk level to the core risk level

②There is a lot of subjectivity in selecting the time horizon:

A longer time horizon could be selected to account for the full business cycle.

⑵RAROC default probabilities:

①point-in-time(PIT)probability of default:

A.It could be used to compute short-term expected losses and to price financial instruments with credit risk exposure.

B.Rating is more likely to change.

②through-the-cycle(TTC)probability of default:

A.It is more commonly used for being taken by the rating agencies,calculating economic capital,current profitability,and strategic decisions.

B.It is used for lower volatility of economic capital.

⑶RAROC confidence level:

①The confidence level chosen in the economic capital calculation should be consistent with the firm´s target credit rating:

For example,a high rating such as AA or would require a confidence level in excess of 99.95%.

②This confidence level as the quantitative expression of the risk appetite of the firm.

③Choosing a lower confidence level will not likely reduce the amount of risk capital required if the firm has little exposure to operational risk,credit risk and settlement risk.

⑷RAROC and other common measures of risk/return:

①RAROC and ROE(or ROA):

RAROC has two specific adjustments:

A.In the numerator,it deducts expected loss(the risk factor) from the return.

B.In the denominator,it replaces accounting capital with economic capital.

②RAROC and others:

The discount rate for the NPV is a risk-adjusted expected return that uses beta(captures systematic risk only) from the capital asset pricing model(CAPM).In contrast to NPV,RAROC takes into account both systematic and unsystematic risk in its earnings figure.

5.RAROC in practice:

Some recommendations for implementing a RAROC system:

⑴senior management commitment:

"What counts is not how much income is generated,but how well the firm is compensated for the risks that it is taking on."

⑵communication and education:

It is to all the management layers of the firm.

⑶ongoing consultation:

"parameter review group"

⑷maintaining the integrity of the process

⑸combine RAROC with qualitative factors:

high quality of earnings | investment | growth |

low quality of earnings | fix,reduce,or exit | managed growth |

low quantity of earnings | high quantity of earnings |

①quality of earnings→strategic importance/long-term growth potential

②quantity of earnings→RAROC return

⑹put an active capital management process in place

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift

Topic 15 The Art of Term Structure Models:Volatility and Distribution

Topic 16 Overnight Index Swap(OIS) Discounting

B.Credit Risk

B.信用风险

Topic 20 Default Risk:Quantitative Methodologies

Topic 21 Credit Risks and Credit Derivatives

Topic 22 Credit and Counterparty Risk

Topic 23 Spread Risk and Default Intensity Models

Topic 25 Structured Credit Risk

Topic 26 Defining Counterparty Credit Risk

Topic 27 The Evolution of Stress Testing Counterparty Exposures

Topic 28 Netting,Compression,Resets,and Termination Features

Topic 32 Default Probability,Credit Spreads and Credit Derivatives

Topic 33 Credit Value Adjustment(CVA)

Topic 35 Credit Scoring and Retail Credit Risk Management

Topic 38 Understanding the Securitization of Subprime Mortgage Credit

C.Operational Risk

C.操作风险

Topic 39 Principles for the Sound Management of Operational Risk

Topic 40 Enterprise Risk Management:Theory and Practice

Topic 41 Observations on Developments in Risk Appetite Frameworks and IT Infrastructure

Topic 42 Operational Risk Data and Governance

Topic 45 Validating Rating Models