大浩浩的笔记课堂——FRM考试学习笔记121

- 2026-02-09 22:22:20

Topic 50 Repurchase Agreements and Financing

1.Repurchase agreements:structure and uses

⑴repurchase agreement(repo):

①definitions:

A.It is a contract in which a security is traded at some initial price with the understanding that the trade will be reversed at some future data at some fixed price.

B.They are bilateral contracts where one party sells a security at a specified price with a commitment to buy back the security at a future date at a higher price.

②factors:

A.short-term loan:

It is secured by collateral.

B.implied interest:

It is the difference between the sell and buy prices of the security.

③perspectives:

A.from the perspective of the borrower:

a/ bond financing:

Repos offer relatively cheap sources of short-term funds or long financing.

b/ liquidity management(balancing the cost of funding and other sources of funds):

Repos offer secured short-term financing and its financing is cheaper but less stable.

B.from the perspective of the lender:

a/ cash management(reverse repo as investment vehicles):

Reverse repos offer a low risk,collateral-secured investment opportunity.

b/ short position financing(reverse repo as financing vehicles):

Lenders may also use reverse repo to finance short positions in bonds.

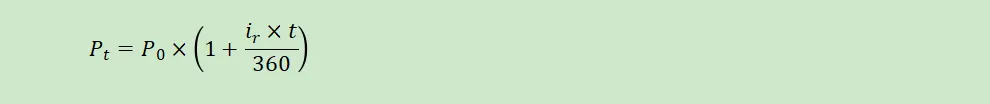

④formula:

Repo price at termination(Repos are valued based on a simple time value of money calculation):

⑵repos and cash management from lender´s perspective:

①lender:

money market mutual fund industry+municipalities

②liquidity:

overnight

③safety:

highest credit quality collateral

·特别注意!

·posting collateral→credit risk

·collateral haircuts→liquidity risk

2.General and special repo rates:

⑴repo trades:

①categories:

A.using general collateral(GC)→GC rate

a/ The GC rate is typically close to,but below the Federal funds rate.

b/ The Fed funds-GC spread is widen:

△the decreasing supply of treasury collateral

△during times of financial stress

B.using special collateral or specials→special rate

Every special rate is typically less than the GC rate.

②summary:

general collateral | special collateral | |

definition | Most repo investor are not usually picky about which particular bond they accept | When lends are concerned with receiving a particular security as collateral |

characteristics | Investors can obtain the highest repo rate | To lender:in order to finance the purchase of a bond(for shorting) or to finance its inventory or propriety positions |

Fed funds-GC spread: It widens when Treasuries become scarcer(the GC rate falls) or during times of financial stress | Every special rate is typically less than the GC rate | |

The GC rate is typically close to,but below the Fed funds rate |

·特别注意!

·special collateral rate<general collateral rate<Fed funds rate

⑵special spreads:

①definition:

It is the differences between the GC rate and the special rate for a particular security and term.

A.GC rate→suit repo investors,funding trades

B.special rate→short particular securities

·特别注意!

·The popularity of OTR issues as special collateral resulted in lower repo rates and wider special spread.

②special spreads in the United States and the auction cycle:

A.categories:

a/ on-the-run(OTR):

The most recently issued bond of a given maturity:

△second most recently→old issue

△third most recently→double-old issue

b/ off-the-run(OTF):

They are all other issues.

B.formula:

special spread=the GC rate-the respective bond repo-rates

C.characteristics:

a/ Special spreads are quite volatile on a daily basis depending on the special collateral.

b/ Special spreads can be quite large.

c/ Special spreads do attain higher levels over some periods rather than others:

OTR special spreads are generally narrower(smaller) immediately after an auction but wider before auctions.

d/ Spreads fluctuate over time:

The cycle of OTR special spreads are far from regular.

③special spreads in the United States and the level of rates:

A.Special spreads move within a band that is:

The special rate should never be less than 0%,the special spread should not exceed the GC rate.

B.The special spread can also be tied to the penalty for failed trades.

C.As a result,the penalty rate becomes the new upper limit for the special spread.

3.Counterparty risk and liquidity risk in repo transactions:

⑴counterparty risk:

①definition:

It is the risk of borrower default or not payment of its obligations.

②reason:

Counterparty(credit) risk is less of a concern,because repos are generally very short-term transactions secured by collateral.

③factor:

posting collateral

⑵liquidity risk:

①definition:

It is the risk of an adverse change in the value of the collateral.

②factors:

collateral haircuts,margin calls,short repo term,higher quality collateral

4.Case study:Repos during the credit crisis:

⑴repos during the credit crisis:

As the crisis escalated,lenders were reluctant to continue to accept these securities,and were increasingly demanding higher quality collateral and larger haircuts.

⑵repos and Lehman Brothers:

Borrowers want to extend the term of their repo borrowings.Lenders,on the other hand,want to shorten the term of their repo lending in order to minimize exposure to default risk.

⑶repos and Bear Stearns:

The loss of confidence had 3 related consequences:

①Prime brokerage clients withdrew their cash and unencumbered securities rapidly.

②Lenders declined to roll over or renew repo loans.

③Counterparties to non-simultaneous settlements of foreign exchange trades refused to pay until Bear Stearns paid first.

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift

Topic 15 The Art of Term Structure Models:Volatility and Distribution

Topic 16 Overnight Index Swap(OIS) Discounting

B.Credit Risk

B.信用风险

Topic 20 Default Risk:Quantitative Methodologies

Topic 21 Credit Risks and Credit Derivatives

Topic 22 Credit and Counterparty Risk

Topic 23 Spread Risk and Default Intensity Models

Topic 25 Structured Credit Risk

Topic 26 Defining Counterparty Credit Risk

Topic 27 The Evolution of Stress Testing Counterparty Exposures

Topic 28 Netting,Compression,Resets,and Termination Features

Topic 32 Default Probability,Credit Spreads and Credit Derivatives

Topic 33 Credit Value Adjustment(CVA)

Topic 35 Credit Scoring and Retail Credit Risk Management

Topic 38 Understanding the Securitization of Subprime Mortgage Credit

C.Operational Risk

C.操作风险

Topic 39 Principles for the Sound Management of Operational Risk

Topic 40 Enterprise Risk Management:Theory and Practice

Topic 41 Observations on Developments in Risk Appetite Frameworks and IT Infrastructure

Topic 42 Operational Risk Data and Governance

Topic 45 Validating Rating Models

Topic 47 Risk Capital Attribution and Risk-Adjusted Performance Measurement

Topic 48 Range of Practices and Issues in Economic Capital Framework

Topic 49 Capital Planning at Large Bank Holding Companies