大浩浩的笔记课堂——FRM考试学习笔记133

- 2026-02-21 21:13:52

Topic 62 Factors in Investment

1.Value/growth investing:

value stocks | growth stocks | |

ratios | 1.high book-to-market ratios 2.significantly outperformed | low book-to-market ratios |

risks | 1.They are risky due to high and asymmetric adjustment costs 2.The value premium compensates investors for losses during bad times(rational explanation) | |

value | They are underpriced relative to their fundamental values,assuming historic growth rates will continue in the future | They are overvalued,leading to a value premium(behavioral explanation) |

2.Macroeconomic factors:

⑴factors:

①main factors:

economic growth,inflation,volatility

②other factors:

shocks to productivity,demographic risks,sovereign risks

⑵characteristics:

①Risky assets generally perform poorly during periods of low economic growth.

②Stocks and bonds generally perform poorly in periods of high inflation.

③Stock returns drop when volatility index such as VIX increases.

3.Managing volatility risk:

⑴changing:

Volatility increases in periods of economic stress.

⑵approaches:

There are 2 basic approaches to mitigate volatility risk:

①Invest in less-volatile assets like bonds,but they may perform poorly.

②Buy volatility protection in the derivatives market such as buying put options.

4.Dynamic risk factors:

Fama-French model:

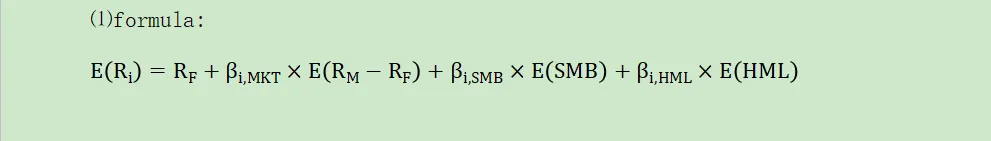

⑴formula:

⑵factors:

The model explains asset returns based on 3 dynamic factors:

①the traditional CAPM market risk factor

②a factor that captures the risk effect(SMB)

③a factor that captures the value/growth effect(HML)

5.Value and momentum investment strategies:

⑴value strategy:

To long value stocks and short growth stocks.

⑵momentum strategy(WML):

To long winners(连涨6个月的股票) and short losers(连跌6个月的股票).

·特别注意!

·This strategy has outperformed both size & value growth effect,however,it is subject to crashes.

大浩浩的笔记课堂之FRM考试学习笔记合集

【正文内容】

FRM二级考试

A.Market Risk

A.市场风险

Topic 1 Estimating Market Risk Measures:An Introduction and Overview

Topic 2 Non-Parametric Approaches

Topic 3 Parametric Approaches:Extreme Value

Topic 6 Messages from the Academic Literature on Risk Management for the Trading Book

Topic 7 Some Correlation Basics:Properties,Motivation and Terminology

Topic 8 Empirical Properties of Correlation:How Do Correlation Behave in the Real World

Topic 9 Statistical Correlation Models—Can We Apply Them to Finance

Topic 10 Financial Correlation Modeling—Copula Correlations

Topic 11 Empirical Approaches to Risk Metrics and Hedging

Topic 12 The Science of Term Structure Models

Topic 13 The Shape of the Term Structure

Topic 14 The Art of Term Structure Models:Drift

Topic 15 The Art of Term Structure Models:Volatility and Distribution

Topic 16 Overnight Index Swap(OIS) Discounting

B.Credit Risk

B.信用风险

Topic 20 Default Risk:Quantitative Methodologies

Topic 21 Credit Risks and Credit Derivatives

Topic 22 Credit and Counterparty Risk

Topic 23 Spread Risk and Default Intensity Models

Topic 25 Structured Credit Risk

Topic 26 Defining Counterparty Credit Risk

Topic 27 The Evolution of Stress Testing Counterparty Exposures

Topic 28 Netting,Compression,Resets,and Termination Features

Topic 32 Default Probability,Credit Spreads and Credit Derivatives

Topic 33 Credit Value Adjustment(CVA)

Topic 35 Credit Scoring and Retail Credit Risk Management

Topic 38 Understanding the Securitization of Subprime Mortgage Credit

C.Operational Risk

C.操作风险

Topic 39 Principles for the Sound Management of Operational Risk

Topic 40 Enterprise Risk Management:Theory and Practice

Topic 41 Observations on Developments in Risk Appetite Frameworks and IT Infrastructure

Topic 42 Operational Risk Data and Governance

Topic 45 Validating Rating Models

Topic 47 Risk Capital Attribution and Risk-Adjusted Performance Measurement

Topic 48 Range of Practices and Issues in Economic Capital Framework

Topic 49 Capital Planning at Large Bank Holding Companies

Topic 50 Repurchase Agreements and Financing

Topic 51 Assessing the Quality of Risk Measures

Topic 52 Estimating Liquidity Risks

Topic 53 Liquidity and Leverage

Topic 54 The Failure Mechanics of Dealer Banks

Topic 56 Introduction of Basel Accord

Topic 58 Basel Ⅱ.5 and Fundamental Review of the Trading Book(FRTB)

D.Investment Risk

D.投资风险